Gold and Silver are at a lower value now (June, 2022) for some reasons.

You may have asked yourself, “Why has the price of gold and silver fallen so much lately?”

For far too many, inflation has been devastatingly apparent with each visit to the under-stocked shelves of supermarkets still in business. Personally, I have gone primarily vegetarian, and I still use all my spare income each month. Lean months are here for now.

I believe that during the last, lean, six months of ever-increasing gasoline and food prices, many people may be selling their closet gold and silver coins in order to make ends meet. It appears that “surplus income” no longer exists for many like me.

Those who long ago believed in silver and gold as a long-term investment have been rewarded. But for those who bought at the crest and sold at the ebb (like right now), not so much.

Right now, one could consider it a good time to buy into both metals at the “lowtide”, because inevitably, high-tide is coming. Roll-searching is always a good tactic, especially so now. The supply is good due to “Grampa’s Collection” showing up through CoinStar machines and available in bank rolls. (Do you check the Coin star reject coin returns?) Always ask your local bank tellers for dollar, half-dollar, quarter and dime rolls, you might get lucky and find old (<1964) silver. After searching, re-deposit the non-silver coins.

Buying at the posted bullion rate is a thing of the past, even though supply is good, per coin premiums (received by the seller) are still high, $5-$7 per silver ounce round (like the U.S. Eagle) and $70-$135 per gold ounce coin.

If, as I believe, the continual selloff of bullion to buy bread is currently a real-time event, occurring world-wide, then why the heck don’t we go back on a silver standard?

A dime’s worth of silver, in a 1936 dime, bought a couple of loaves of bread. There’s roughly 1/12th of an ounce of silver in that Mercury Dime, of inherent value because of its silver content. *

An MS, or “Mint State” silver dollar could be worth anywhere between $50 to $250,000, depending upon date, mint marks and condition. (MS70 being perfect.) An old worn-out Morgan Dollar still fetches $20.50 on Ebay;

https://www.ebay.com/itm/265745913663

For the old closet coins from Aunt Jane’s collection that were given to the kids with the ill-advised suggestion to have “fun” with them, getting face value for candy and plastic toys became the boon to the candy and toy sellers smart enough to take the time to really look at the coins.

When silver dropped to $20.50 an ounce this week, I found myself asking why?

Maybe Mom and Pop had to cash in a few silver “eagles” to help pay the mortgage and do the grocery shopping this week. With the effects of the current inflation and potential recession, the needs of basic survival will take precedence in regards to some home budgets. Unless something is done to supplement fixed earnings in an inflationary period, shortages will occur causing demand to go up as supply dwindles. This current period reminds me of 1979-80.

Those people who bought silver and gold years ago may have done well, depending upon exactly when they made their “investment”. The run up of silver bullion prices in late 1979 caused many investors to enter the market at various steps along the price rise in silver bullion from $4 to $47.88 an ounce. The old adage still holds true, “Buy low, sell high.” The lower you buy, the more potential for profit there is in the long game, and this fact drove silver investors wild.

Those who purchased silver in the early 1970’s, at a period of bullion activity very similar to today, stand to profit despite the low current value. Availability of inflation “cash-outs” has driven the silver bullion values downward.

I believe that this gold and silver selloff is occurring regularly with both typical consumers and hard-line commodities brokers. A glut of availability occurred when China flooded the market with physical silver early in 2021. Availability seems to be unclear though. Bullion sellers now charge higher premiums on their products, and cannot promise physical bullion to meet investors demands. Still, investors continue to buy both gold and silver at the lower prices. We may see the day that silver breaks $49 an ounce as it did in 1980.

On March 27, 1980, The Hunt brothers missed a margin call and the price of silver went from $47.88 to $11 per Troy ounce overnight. The Hunt’s had tried, unsuccessfully, to “corner” the silver market by buying futures and live silver far beyond their abilities to meet the stock market’s margin call to produce cash in the amount of their supposed holdings.

Today the need for ounces Troy of silver ($20.81) and gold ($1819.70) in production of aerospace, cars, electronics technologies and jewelry/bullion increases faster than the rate of production of these ores.

Many inherited bullion coins are spent for their face-value by people ignorant of their numismatic and bullion values.

More on when Aunt Sally left her coin collection to the kids, “…to have fun with”;

Using their face value, silver dollars, silver quarters and silver dimes were squandered to buy $7.75 worth of worthless toys and candy. The kids were oblivious of the actual bullion value ($115) of the silver coins in Aunt Sally’s modest collection that they “inherited”. Among the silver dollars was one dated 1893, and below the eagle’s tail feathers on the reverse, was a small “S” mint mark. Although worn, this coin alone was worth over $5,000.00.

Had only a more knowledgeable adult taken the time to look at the coins in Aunt Sally’s collection, the kids could have bought $5,000.00 worth of toys and junk food! But the other side of the coin is this:

A very happy toy store owner took $35 for the 1893-S Morgan dollar, and he felt that he really got a bargain! The buyer sold the same coin to a coin dealer for $1,200.00, who sold it to a Pawn Shop owner for $3,170, who sold it after having it encapsulated and graded VF-35 CAC by PCGS for $5,150.

If you believe in luck, check the rejected coin return on the Coinstar machine at the supermarket. Do yourself a favor and buy a roll of dollars, half-dollars, quarters and dimes next time you go to the bank. You might get lucky.

They happily spent the coins, splurging on these childish commodities. To a kid, candy and toys are a priority, so any loss is unimportant.

*(2.5 grams or 0.088 Troy ounces, about $1.45 worth today)

Uncategorized |

Uncategorized |

Posted by jporter852

Posted by jporter852

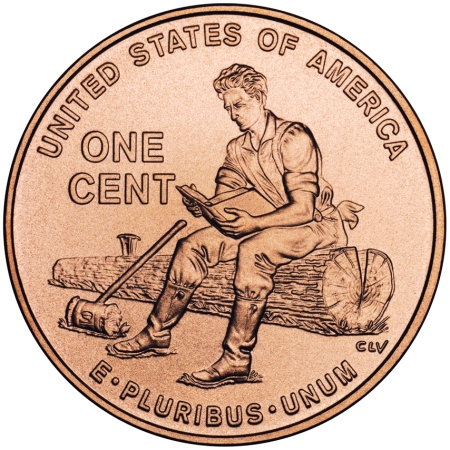

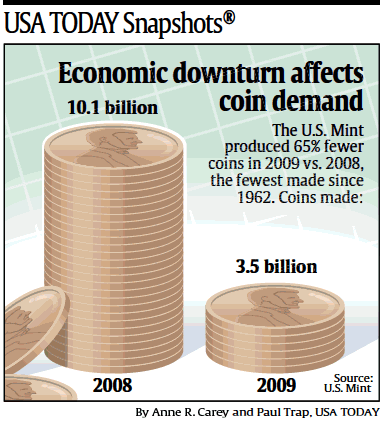

Early in 2009, the economy in the United States was suffering from a banking crisis, imploding real estate bubble, apathetic coin collectors wanting something new and different to chase, and a near bankrupt government. When the U.S. Mint announced a new series of four reverse designs on the cent coin, which would commemorate Abraham Lincoln’s birth bicentennial, the coin collecting world became quite excited in anticipation. Knowing that the 2009 lesser denominations would be limited in number, collectors smelled potential profits.

Early in 2009, the economy in the United States was suffering from a banking crisis, imploding real estate bubble, apathetic coin collectors wanting something new and different to chase, and a near bankrupt government. When the U.S. Mint announced a new series of four reverse designs on the cent coin, which would commemorate Abraham Lincoln’s birth bicentennial, the coin collecting world became quite excited in anticipation. Knowing that the 2009 lesser denominations would be limited in number, collectors smelled potential profits.